Understanding Link Mesh Price A Comprehensive Overview

The concept of price in the context of crypto assets is multifaceted and constantly fluctuates due to various market dynamics. One of the intriguing areas within the cryptocurrency landscape is the pricing of decentralized financial products, particularly those related to the Link mesh network. This article delves into what Link mesh price signifies, its components, and the factors influencing its fluctuations.

What is Link Mesh?

Link mesh refers to a decentralized network structure that enhances the connectivity and reliability of blockchain applications. Primarily associated with the Chainlink (LINK) ecosystem, which provides tamper-proof data feeds to smart contracts, the concept of link mesh facilitates a more resilient data aggregation system. This decentralized architecture helps in minimizing the chances of single points of failure, thereby increasing trust among users. The Link mesh network allows multiple nodes to work together to validate transactions and provide reliable data, making it a cornerstone of the decentralized finance (DeFi) ecosystem.

What Determines Link Mesh Price?

The price of Link mesh assets can be influenced by numerous factors, including supply and demand dynamics, market sentiment, technological advancements, and regulatory developments.

1. Supply and Demand Like any other asset, the fundamentals of supply and demand are crucial in determining the price of Link mesh. If there is a high demand for decentralized services and the availability of LINK tokens is limited, the price is likely to increase. Conversely, if the supply outstrips demand, prices may fall.

link mesh price

2. Market Sentiment Investor psychology plays a significant role in the pricing of Link mesh assets. The crypto market is highly speculative, and sentiments can change rapidly due to news, social media trends, or influential figures within the cryptocurrency community. Positive developments, like successful partnerships or technological breakthroughs, can drive the price up, whereas negative news can lead to sudden drops.

3. Technological Development The ongoing development of the Chainlink protocol and its ability to scale and integrate with various blockchain platforms directly affects Link mesh price. Enhancements that improve the efficiency, security, and interoperability of the network can boost investor confidence and drive prices up. Conversely, any significant bugs or security vulnerabilities can lead to a decrease in price.

4. Regulatory Environment The cryptocurrency sector is continually evolving under the scrutiny of regulatory bodies worldwide. Introducing rigorous regulations can impact the operations of DeFi projects and indirectly influence Link mesh prices. Positive regulatory news may lead to increased adoption, while negative news can create uncertainty, leading to price declines.

5. Market Trends Broader market trends also play an essential role. If the overall cryptocurrency market is in a bullish phase, likely driven by positive developments or significant institutional investment, the price of Link mesh could soar. On the other hand, bear markets can result in price drops across the board.

Future Outlook

As the adoption of blockchain technology and decentralized finance continues to expand, the Link mesh and its associated pricing will likely become more critical. Investors should stay informed about the latest developments in the Chainlink ecosystem, understand the macroeconomic factors that influence pricing, and keep their risk tolerance in check.

In conclusion, Link mesh price encompasses various factors that coalesce to form its dynamic nature. It serves as a reflection of the broader market sentiment, technological reliability, regulatory stance, and the fundamental principles of supply and demand. As this market continues to evolve, staying abreast of these factors will be essential for anyone looking to navigate the world of decentralized finance successfully.

-

Why Galvanized Trench Cover Steel Grating Resists Corrosion

NewsJul.10,2025

-

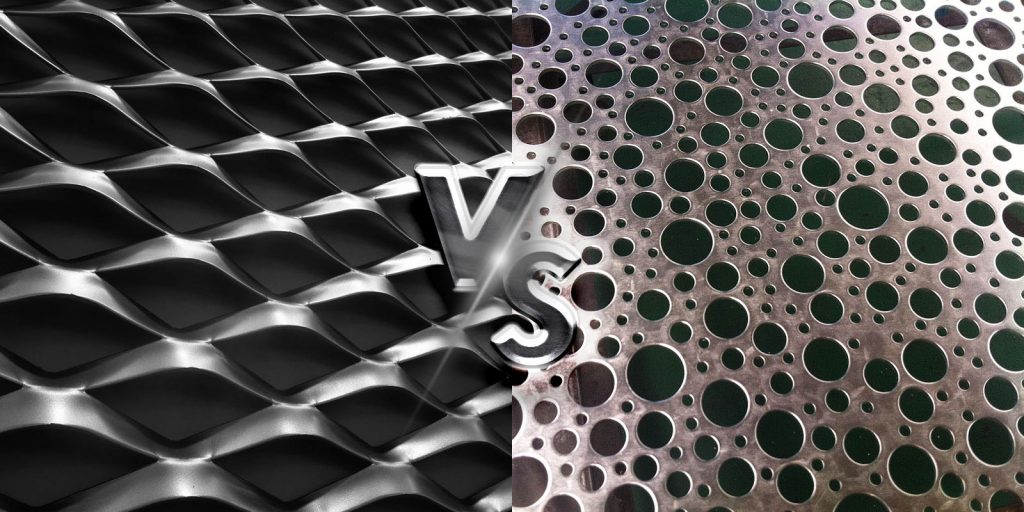

The Versatility and Strength of Stainless Expanded Metal Mesh

NewsJul.10,2025

-

Load Calculations in Steel Grating Platforms

NewsJul.10,2025

-

Keeping Pets and Kids Safe with Chicken Wire Deck Railing

NewsJul.10,2025

-

Hole Diameter and Pitch for Round Perforated Metal Sheets

NewsJul.10,2025

-

Aluminium Diamond Mesh in Modern Architecture

NewsJul.10,2025

Subscribe now!

Stay up to date with the latest on Fry Steeland industry news.